This is the jounery of debt, Recovery

and Eventually Money!

Credit is for the poor to keep them poor.

"Debt should only be for a house, not a car, not a holiday, and 100% not for cash."

Here’s my story… After amounting almost £40k of debt from going to university, mainly from what I perceived as free money thrown at me by the banks as a student. I collected this up from overdrafts, credit cards, student loans and tuition fees that I believed at the time would just disappear. Once I graduated the reality really kicked in, and the debt I was holding, turned into something like quick sand, it became pretty scary when my student accounts expired and I moved into regular current accounts. While looking for a job as a post-graduate my debts, especially my credit card bills seemed to only get bigger and bigger.

I made a silly mistake, luckily only once, by withdrawing cash from my credit card. Not realising at the time this was at a higher interest rate than purchases. Natively I trotted off to the bank to pay back the cash element of the card as my repayments went up considerably. What they told me was that I couldn’t do that and the cash would only be cleared once I cleared the whole debt! I argued I had £8k on my credit card and this was sending my repayment ability into something I could not handle, but they said “well you shouldn’t have done it should you” …. Well, no sh1t! I believe it now, but at the time I was in shock, I just could not believe how the system worked, it was criminal in my eyes... Looking back this was the best lesson I ever learnt. From that day I swore, yes at the bank, but also to myself that I would destroy that damn credit card and never use it again. I was furious, and made it my mission to remove all my debt I had with this corrupt, debt-ridden system which was trying to ruin my life. Over the next 5 years I actually managed to beat the system

This is how I did it... And I used the banking institutions to do it.

Getting out of Debt

Life Hack - Making the banks work for you

Firstly, have 2 bank accounts, one for bills and your wage, the other for spending.

Never spend any money from your wage and bills account directly, only allow payments by standing order or direct debt (I would destroy the card so I wouldn’t be tempted). Only transfer money to the spend account in emergencies or the occasional holiday (This was very late on in this particular journey).

Pay yourself a monthly spend limit, a spending wage as such. This is how I operate now debt free, which is how I achieve some of the other life hacks I will talk about, but at the time I set myself a £400 limit, £100 a week, now a days you might need a little more, especially with the price of a weekly shop!! With this spend limit, I used my overdraft to my advantage, I limited the overdraft amount (at the time it was £1,200) I would clear £400 pounds off my total owned and spend the banks money from my overdraft and before the end of the month, pay my next instalment of £400 by standing order, this meant I didn’t pay any interest on the money I was using and treated it like one of my monthly bills. Plus, any money I didn’t spend meant I had less negative balance the following month. Over time I was reducing my overdraft limit to keep within the £400 allowance and after about 18 months I was in touching distance of being out of overdraft debt. I did actually keep my overdraft for a few months after that, until I got to a plus £400 at the end of the month so I was 1 month in advance.

The part I haven’t spoken about here I will cover in the next hack but to keep my interest levels low on my overdraft I was constantly moving my bank accounts for 2 reasons, one was to take advantage of overdraft fees the other was about account incentives. This moves nicely to my next banking hack.

Life Hack - Banks will actually give you free money

Constantly switch current accounts!

Banks will play you cash incentives to move your accounts, now a days this is loads easier with automated switching services, at the time this was a pain, but definitely worth the reward, in 1 year I made a £1000 from switching my 2 accounts for cash incentives and I used this money to help elevate my debt burden which I will talk about later on. I have to say though, do read the offers, as the time between receiving the money can vary, anything between 1 - 6 months. What I did was work through the offers on a timeframe of the return basis, starting with the shortest to the longest, but I would switch to any bank that would give me actual free money, there are many offers like this if you look hard enough and it’s not just the big 6. After a certain period of time, you can do it all over again, this may not be the case anymore, but it can’t hurt to try, I was moving addresses at the time, and also maybe I was not with the banks very long and moving from many different banking institutions I was not noticed, so give it a go… at the end of the day they will take money from you in a minute’s notice.

Life Hack - Credit card debt, the only way out

As I’ve mentioned I had £8k of credit card debt and after withdrawing cash with it, it changed my whole view on banks, I spoke with my friends about it as I was quite upset and my monthly payments had really gotten out of control. One of them mentioned why not move your credit card balance to an interest free card for 6 months. Eh!? That’s a thing? I didn’t know at the time you could do that! For me this was it… the way out! I was paying a small fortune each month in interest alone, so I actually moved to the card company my friend was with. I was paying close to £350 a month anyway and was just about scraping through each month, so rather than reduce what I was paying, what I did was maintain that amount, but this time it was purely balance repayment. I can’t tell you the relief this gave me, and yes like my current account hacks, I was straight onto the next credit card interest free offer I could find. With in 3 years, I did what I thought was impossible, I cleared the debt, it was hell, and I have to say a lot of sacrifices were need in that time, but the feeling when I was at zero was immense. It’s worth noting at times the offers were not always available, but some would give a reduced rate for a similar period of 6 months so I used them until the next interest free offer came around, and would switch immediately. As the balance got lower, it then became easier and easier to win.

I still remember the feeling I had when I paid my last credit card payment, it was truly freeing and I said that day I would not ever use a credit card again. To be honest with you, I do have credit cards now, notice I say cardsss. This moves me to another life hack.

Life Hack - How to take advantage of credit cardsss

Credit cards come with some perks, but I have to say credit cards are issued by the devil. Know this when you use them. The thing with credit cards is, they give you incentives to lure you into debt. But because they are offering a debt (please notice my language here I use debt not credit, because that is what it is) they have to insure against the risk, this means insure your purchase. You are buying the purchase with debt, even if it’s for part payment of the purchase. The banking institutions who provide the debt, gives the purchase insurance, such as, if you pay for a holiday and the company goes bankrupt, they will refund the total amount of the holiday, this works with any purchase you make. So, when I book a holiday or buy a car, I always put the deposit on a credit card to protect my purchase and pay the balance off immediately. The cardsss bit is I will also find a credit card that offers a cash incentive on a purchase usually in points that means I get a % return from the amount I spend, some you can withdraw as cash! Remember my upset at this, it’s me getting my own back… also I do love a discount!

Building Wealth

I have to be very clear I am not a financial advisor in any shape or form, I am only sharing my experiences and what I have found through trial and error, so everything I discuss here is purely my journey and what I found worked for me.

Life Hack - Understanding wealth and how to generate it

The first thing you need to get right in your mind is the differences between assets and liabilities. I’m sure you know the meaning of both words but truly understanding this will help you build up wealth… as both can help you generate wealth.

In the world of building wealth, the aim is to have more assets than liabilities. Assets are obvious, you should spend your money on assets and don’t waste money on liabilities. It gets complicated when you can argue a liability as an asset and vice versa. Like a car for hire or an investment that fails. But let’s keep things simple, I will share with you my realisations about both.

I can hear you saying "yeah, yeah, I’ve heard it all before but where do I get the money to get these assets?" I thought exactly the same, but it turns out its possible as I did it with a pretty low income.

Life Hack - Building wealth from Liabilities

Generating wealth is not just about income, it’s also about managing your outgoings, I don’t think people fully appreciate this. So, for now, let’s not worry about making money, as I found that making money was a lot harder. What is a lot easier is actually reducing liabilities and this actually generated a lot more money that I thought possible, especially when I was starting out. "See credit is for the poor". This was massive, but also as part of that journey, I really had to make sacrifices to achieve the things I wanted in life, “nothing in life worth having ever comes easy”, To do this I had to know what I was spending, and on what, I’m not going to tell you to shop around for better deals on your bills, though do this, but what I will say is know what you need and what you don’t.

For me finding my way in my early years, my biggest expenses or liabilities were rent, debt, bills, food, leisure/social and tax (forget this one for now but I will talk about this later). Which brings me on to my first life hack in this section.

Life Hack - Pt1 Know what you have to pay

This is a boring one and so I’m not going to say too much, but write down all you’re must pay bills, and know exactly how much you have to pay each month to have a roof over your head. Subtract what you earn each month and this gives you your disposable income. This is your base, and yes keep up with what you can save here but it won’t be much of a variance, and will only likely increase as you get older, but keeping this as low as possible will only make your wealthier. What I don’t mean here is having 1GB internet connection with full TV package of sports & movies, I purely mean house, heating and power, bare essentials that you have no choice on paying. I will talk about ways to make some of these liabilities, assets later! Part 2…

Life Hack - Pt2 Know what you waste on the most

From here the questions you need to ask yourself are... do I need to eat takeaway 3 nights a week, I did, do I need to buy that new jacket and shoes, you guessed it, do I need to go to the pub every night, well this isn’t entirely true but a big weekend was just crazy expensive and daft. These liabilities are genuinely bigger than you realise. When I was working through my debt management, I had to do this to survive. Take a look at your monthly account statement, excluding your base (bills) for the last 3 months and spreadsheet or write down everything you have spent on what each month (exclude December for obvious reasons) categorise them into spend areas like takeaways, real food, retail, social, you will work this out from your own habits what these should be, but be honest with yourself and keep the number of categories as small as possible. Then add each month’s category together and divide by 3. This will give you an average spend per month, and trust me you will be shocked. I won’t need to tell you what you are wasting your money on, it will hit you in the face like a freight train.

Mine was nights out, I was averaging £700 a month! No wonder I amounted all that debt and for what, a hangover, I deeply regret the waste at such a young age now, though at the time it was brilliant! Cutting out or back on these, can open huge amounts of money. This is how to start building the funds to grow your assets.

Life Hack - Spend your money on reducing your liabilities permanently.

This is where things get interesting, and I am still talking liabilities, wait for the assets bit! but these hacks are genuinely what I believe to be the making of my life, and they are simple. It’s about being smart with your money. Savings accounts are good but they do not give you the type of money that you get from removing liabilities. So, these are in simple terms what I did once I started being smart with my money.

Life Hack - renting is for idiots.

Haha, I can already hear the abuse, not everyone can afford not to rent, well, I say if you can afford to rent you can afford to buy. Yes, yes, the deposit, and how do you get that when I have to pay all this rent! A paradigm I know. But it’s still true renting is for idiots, what I was doing was spending huge amounts of money on building someone else’s wealth. The day I realised this was actually trying to get a deposit back from a landlord. They were trying to claim I needed to replace the carpet where my office chair had worn a section, and that where my chest of drawers was in the bedroom, had caused damp in the wall. I had lived in the flat for 30 months at £500 a month (this was several years ago) and as part of my argument I did the maths on what I had paid them during my tenure... £15k for 30months!! One, five! It blew my mind looking at the numbers. This was house deposit territory! It actually made me sick the thought of the amount of money going to someone else.

Life Hack - Buy a house and buy one early.

I genuinely feared buying a house because of the huge debt burden, the commitment, and being tied to a house… not knowing if I could afford it, getting bad credit for defaulting on a mortgage… loads of doubts which made me delay the leap. Though, once I bought a house, I could not believe the wealth this generated and how my bills only went down not up. But I will share with you what I learnt from braving it and the mistakes and realities of doing it. Personally, I think they should teach this in school but who am I to judge. The point is, it’s easier than you think and I quickly learnt you can’t lose, especially when you understand the system. I really wish I had bought a house years before I actually did.

Life Hack - your first home will not be your last home.

You need to remember when you buy your first house this is not going to be a forever home. In fact, it would be daft to make this your only home as you will be building up wealth you can use elsewhere to expand your assets. When I have talked to people, they want to buy their dream home straight from the get go! Now if money is not an issue for you then fine, but the other 99% of us it is, so, in the same hack as “Buy a house and buy one early.” Your first home should be to generate equity. I did this with a little bit of luck, it wasn’t my intension. The house I chose was in a nice area but hadn’t been touched really since the 1970s and really needed a makeover. The luck was out of necessity and affordability, but looking back, if I could do it all over again, I would. “Buy the worst house on the street and make it the best”. This is what I did.

Making Money

I have to be very clear I am not a financial advisor in any shape or form, I am only sharing my experiences and what I have found through trial and error, so everything I discuss here is purely my journey and what I found worked for me.

Life Hack - My first asset and return

I think part of the fear I had was being tied into a mortgage for 25-30 years, I would be stuck with it and I would be paying the sort of numbers I was first shown on my repayment amounts, and this was more than my rent! At the very start this is true. But what naturally happens afterwards is not the case. When I bought my first house, I paid £190k, I had saved £25k to pay for fees, stamp duty and my initial deposit. I was scared about the market and wanted to secure a long-term mortgage so it wouldn’t go up. First time around I had a mortgage advisor (a friend of the family) that very rightly told me not to fix my mortgage for more than 2 years as things change, all he said was “things change so don’t do that”, I didn’t really know what that meant, but now I do. What he meant was house prices will generally go up and repaying my mortgage means the loan is always going down.

Mortgage repayment % is based on risk of what they call Loan to Value LTV (how much you owe to what the house is valued at) As a first-time buyer you will likely have the highest level of LTV, in my case 90%, some 95%, so the mortgage deal will be the higher end %.

For me at the time I was paying around £900 pm. But after my first 2 years of my fixed deal, I went back to the mortgage company, (this is what everyone does apparently), it’s like when your deal ends with your internet provider, you get a new deal, plus they give loyalty bonuses called remortgage deals which are lower as well, I didn’t know this. They also constantly revalue the house and this time it was valued at £220k and because I owed £163k (after my deposit and 2 years of repayments) I now was at 75% LTV. Which meant I had a hugely different interest rate, and this actually reduced my mortgage payments to £750pm. Your bills/liabilities reduce! No one told me that!! Not only that, I now had almost £50k worth of equity in my house after 2 years. In my mind, I had only spent in real terms £25k plus “rent” for a return of £50k!! My reaction was like a looney tunes cartoon!! This was the second liability that I had permanently reduced, but also at the same time created my first asset.

Life Hack - Generating Money to build your assets (deposit for a house?)

I bet you were all waiting for this one, and I am guessing you think it will be lame. I suppose a little bit it is. You will need to make sacrifices, and use your spare time to work on ways to make extra money. It could be through your job, overtime etc or by getting a paying hobby which is what I did. But at the end of the day, you will have to work at it and it won’t be easy. For me at this point I was being smart with my money so I could flex and cut back on my waste to allow me to save money. It wasn’t much but because I had cleared the worst parts of my debts and I had been paying so much, for so long, it was just a case of sucking it up for a little longer. But I will explain what else I did to generate extra income.

Life Hack - Making Money work harder while you wait

Again, I am not a financial adviser, I am not qualified to give people financial advice, all I am sharing is what I would do or have done. The process of buying a house is a long one. You will need to have a plan to get the money you need, but if you are at this stage, you must have some money ready to do this. These savings are an asset as you can make additional money from it to support the generation of wealth. Nowadays, if you make any profits from savings, you could have tax implications, I personally don’t like giving this away to the government. But there are options to save money and make money without tax implications. These are called ISAs, and one particular ISA can be used for buying a house, if you are under the age of 40, called a Lifetime ISA. You are allowed currently to put £4k into a lifetime ISA a year and the government will give you 25% up to £1000 per year to one of these! That is huge, the likelihood you will need more that £4k, but its a very nice bonus. If you are a couple buying a home get one each and split the savings into it to get the maximum you can get. (Note that a Lifetime ISA can only be used to buy your first house or go to your retirement, and you can only have one if you are under the age of 40) So while saving for your house. This is a no brainer if you meet the criteria.

Additionally, you can open other ISA types up to a total amount of £20k (the £20k includes the Lifetime ISA so if you have £4k in a Lifetime ISA you can put £16K in other ISAs) These other types of ISAs you can access the money anytime, but they are all tax free.

Life Hack - Hobbies that make money

Ive moved this section to a dedicated page so others can share their own hobbies that make them money, hopefully to help everyone make some extra cash.

Making Extra Income

Here is a list of hobbies that have made me or my family money, with varying degrees of success... I’ve tried to order them in what I’ve had the most returns.

Assets & Taxes

Jumping forward 14 years I have managed to build a decent number of investments and assets, all from managing my liabilities and investing my disposable income into generative assets that I’m working on to providing me with a working wage.

The majority of my money is in ISAs now and I kick myself for not using my ISA allowance earlier, you can only put a maximum about of £20k a year into them, once the tax year has gone the allowance is gone. If I had used even a little of this for the years that I had missed, I think I could have retired by now. So, this leads me to my first asset life hack.

Life Hack - know the deal with ISA's

ISA (individual savings account) is a tax-free savings or investment account that allows you to put your yearly ISA allowance into an account which shields it from income tax. The interest you earn off this is tax free and as long as you keep the money in the ISA, any interest off the interest you earn is also tax free. E.g. if you put £5k in an ISA and year 1 you earn 2% (£100), next year you keep the money in the ISA you earn another 2% (£5102) and you continue this for your whole life, you will never pay a penny of tax on this again. Imagine this on £400k at 5% interest... that would be £20k tax free a year, every year. Hence why I am kicking myself.

Life Hack - Maximise your ISA allowance.

I came across ISAs (though I had heard about them) from a news article that was about the number of UK ISA millionaires. There were a couple of thousand of them in the UK it went on to talk about how these people would have huge tax-free incomes and the divide between the rich and the poor getting bigger, this sparked my interest, and me being me, I ran the numbers on different interest returns on that a year. £1m at 5%, wait a second that’s £50k a year, every year! Tax free! At the time I was earning somewhere around that in my job and I paid huge amounts of tax and NI on it. These people who had been smart with their money could get that with no liabilities. This was right up my street. Hobby? Nerdiness? An interest is building wealth? Hell yeah, I’m going to give this a go! Just to be clear I do not think I will ever become one, my interest in this is purely earning money from an asset with the added bonus of not paying any tax on it.

Now I’ve mentioned Lifetime ISA for saving for your first home, that can also be used at retirement age, otherwise withdrawing it for any other reason you lose the 25% government contribution. These are amazing but personally I think you will need the money before retirement age so I personally would only use it for saving for your first house. These have long past me as I’m over 40 so I will say no more.

I started off using a cash ISA, dipping my toe in the water so to speak, which is basically a savings account (it pays less interest than normal savings accounts, but its tax free and uses your ISA allowance. I think if you are not willing to do your research these are the best options as you know what you are getting, simple and straight forward.

Though during my research, I came across a different ISA called an investment ISA, this is what I use now. The investment ISA you can put money into stocks & shares, investment funds, EFTs similarly to a pension. I have to be clear again I am no financial advisor, I am not trained or have any financial education, this is all self-explored and googled. But I will talk through what I do, I’ve done pretty well out of it, its not fool proof, there is risk to investing money this way, my way is not scientific, I just use what other people invest into to make my choices and I regularly bank my money by selling the funds.

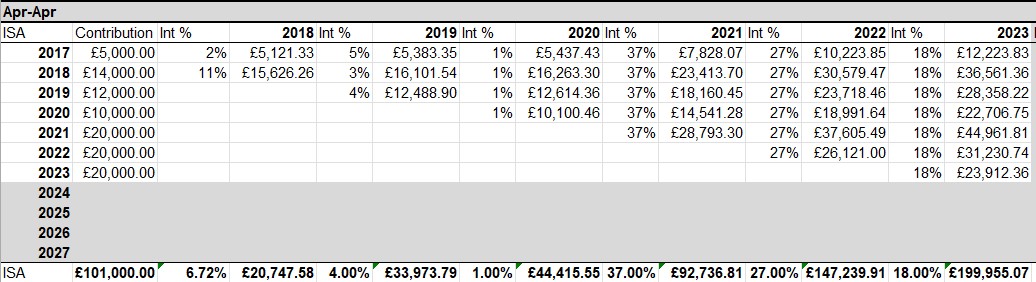

I’ve included a snapshot of a spreadsheet on what I’ve invested in ISAs since reading the article, in 2017 I added £5k into a cash ISA which I got under 2% on (the spreadsheet rounds up the interest), but in 2018 I moved all my money into an investment ISA. I average my returns as I split my money into different investments, but you can see what I have done over the last 6 years. I’ve put £101k into ISAs and my current balance is just shy of £200k. (Please note we had a pandemic in the middle of this which really added some market fluctuation) 1 year I made 1% another 37% hence the risk factor I am talking about.

Life Hack - What you need to manage an investment ISA

Basically, all you need to manage an investment ISA is an account with a trading platform, they are very common and usually come with an app and website that you can buy and sell funds with (as well as all the other financial market product types I mentioned in “Maximising your ISA allowance”) Investment ISAs are provided by many different types of providers. The main ones I use are:

I have accounts with both of these, but I use them differently, my ISAs are with AJ Bell, and H&L for the occasional share trading and savings account. (H&L have a really cool savings account indexer, you can open and add the highest interest accounts directly through the H&L platform). The reason I choose AJ Bell for the Investmetn ISA is no other particular reason than fund trading and fees with AJ Bell are cheaper. Both platforms are easy enough to use and have their pros & cons.

Life Hack - The VidualNet approach to managing an investment ISA.

I do feel I have to write lots of disclaimers for this, I don’t mean to bore you, but also, I don’t want you to turn around and say I lost money because I did what you said. My default is “always get professional advice”, then if it doesn’t work for you, you can blame them and not me :).

My approach to this is actually quite simple, I only invest into funds, which are a grouping of shares or sometimes other funds in a particular financial market packaged into a fund, there are 2 reasons for this:

I do my research before buying any funds and I am constantly watching what is happening using google finance. Google finance has an option to add watchlists and what I do is add the top 10 shares of a fund to a list and is shows me the stock price movements and also gives me daily news about those shares, I do read this news most days.

How I choose funds is even simpler. I look at the previous months most bought and sold investment funds and if something that takes my fancy such as a fund that is moving up the rankings, I add them to a watchlist and read the articles and if I think it’s doing well, I will buy a proportion of that fund, and that’s it, there is no science to it.

Share your Life Hacks @ MoneyNet by VidualNet.com

The best things in Life Hacks are free

Money! & Money!

Lets be realistic about things here, yes yes money is the route of all evil, money doesn't buy happiness, no amount of money bought a second of time... But I want some of it all the same.

Health

When I was young I was athletic and fit. When I went to Uni it fell off a cliff, when I turned 30 the aches and pains started, when I turned 40 oh my god my eye sight!... Simple things I do better.

Happiness

I chuckled with this section as there are so many factors, the 2 over there are possible contributors and disruptors! Life is about balance..I hope i can share something of interest.

Like what you have seen on VidualNet?

This is the part of a website not many people bother to visit as they are getting into the good stuff, but just in case.